|

I’ve been talking to folks over the last little while about the Film Tax Credit and what insights and improvements it might offer for other creative industries, manufacturing and other industrial tax incentive models such as the payroll rebate system. This is a brief analysis of how and where tax credits work along with a short case study. Lot’s of folks have been talking for a while about how to harness the great sustainable success of Film Industry Tax Credits in other creative industries. Though it’s been discussed for years, it’s been difficult to get consensus on how Tax Credits could be applied, particularly to the music business which some people see as analogous. This is a discussion paper outlining issues and ideas. How The Film Tax Credit Works A film tax credit is a regionally structured, labour-based tax credit. If a Producer employs creative folks in the film and TV business that attracts external investments, particularly TV licences, Federal funding, industry funding and distribution guarantees, he can have that expenditure audited, verified and checked over and if all is good he can claim a tax credit equal to roughly the amount the people he employed paid in taxes (including an economic impact multiplier). In this sense tax credits are Revenue Neutral. That is to say that the source of their financing comes from the tax paid by the people who work on the project whose jobs would not have existed without the project. At very worst it’s a wash, but in reality the people, the jobs, the ideas and the economic activity make a huge positive impact on Nova Scotia. The simplest explanation for this is that government is using taxes collected on high-paying, skill rich, creative work that would not have come to the region under any other circumstances to buy those jobs. Put even more simply, they are buying money. And it’s on sale! They’re getting it for about thirty cents on the dollar. The difficulties and alternatives So how can this successful industrial development tool by applied to other types of creative manufacture? Good analogies in other creative industries are not easy to come by. Few businesses have the scale, the finite schedule, the detailed accountability and the verifiability of a TV or film production. Few other creative industries so plainly draw in investment capital as part of their basic business model that would not come to Nova Scotia under any other circumstances. Over at NSBI they work the same model to draw industry investment to Nova Scotia but they call it a Payroll Rebate and they pick and choose specific businesses to qualify instead of simply opening it up to all businesses in a certain sector or area like the Film Tax Credit. There’s lots wrong with the pick-a-winner style of economic development, mostly it’s just discouraging to all the people and businesses that don’t get picked, and the payroll rebate has not been nearly as successful as the Film Tax Credit. What makes a good tax credit candidate? 1/ Is it a clean, low impact, industry that positively affects Nova Scotia at home and our reputation in the world? 2/ Does it draw in investment that would not come to Nova Scotia under any other circumstances? 3/ Does it require a variety of highly skilled labour positions and offer rich, meaningful, good paying jobs? 4/ Are the companies and projects of such a scale and professional quality that they can handle the administrative responsibility of financing their own business and then auditing the results and proving they have done everything they promised to do before getting any tax credit benefit? 5/ Is it a consistent or growing sustainable industry with promise for future development? It’s pretty simple. We want to support ideas that are positives for the community, that attract and keep creative, positive, skill rich work in Nova Scotia. We want to attract investment. We want to keep our risk at zero by only committing and paying out after the project has verified through audit that it has done everything it said it would do. A good analogous business - Shipbuilding Shipbuilding would be a good candidate for a tax credit system. It’s interesting creative work. It’s a proud part of our heritage and our future. It a positive part of our story at home and abroad. The companies are of a professional scale, even small boat builders, that they can deal with the financing and reporting requirements needed to responsibly account for the people’s tax money. Boats are built on project schedules with clear beginnings and ends that lend themselves to clear accounting and labour billings. A new ship or boat is commissioned. The investment money comes to Nova Scotia. The ship is built and delivered. The builder reports to government, is subject to a detailed audit and then is given a tax credit based on the Nova Scotia labour he employed in the ship production. Instead of the loans, gifts and gobbly gook given away for the Irving navy shipbuilding project, they could have structured a highly accountable, performance and success-based labour tax credit that would have been a lot more responsible and transparent to the tax payers. Importantly, it could have been a shipbuilding tax credit available to all builders – new companies and old, big and small alike - not just the Irvings. To find other types of industries that might be a fit for a tax credit some compromises may have to be made. If the tax credit is a fit for TV and film or shipbuilding why not the music business? Looking at the desirable requirements: 1/ Is it a good clean and desirable industry? Yes! 2/ Do they draw in money from away that would not come otherwise? Well, sometimes, but not as part of the basic business model structure. In the old days when their were record companies it might have been possible to induce them with a tax credit, but their decisions are talent based and no amount of money will get someone to back, buy or listen to music they don’t like. Web development, interactive or otherwise can sometimes draw in money from away, but that’s not the core of the industry and tax credits would not likely make a difference in most financing cases. So, generally no, industries like this, though they have successes, don’t have the attraction of investment capital as a core foundation stone of their productions. 3/ Do they create great quality interesting work? Yep! 4/ Are they of such a scale, schedule and structure to handle interim financing and make transparent, verifiable, accountable audits on which to base labour tax credits? Again, no, some, maybe a few, are, but it’s generally not a hallmark of either industry. 5/ Are they consistent, sustainable or growing industries or sectors? Sure! Sooo… 3 out of 5. We can give up here or we can consider how and why we could make tax credits work for these kinds of industries that don’t perfectly fit the economic model yet there is considerable will to encourage them. Applying Labour Tax Credits to the Music Industry Music is a great cultural product close to the heart of Nova Scotia. We currently have a mishmash of agencies, grants and organizations, heavily bureaucratic and often elitist, funding ad hoc musicians, bands, events and other arts organizations and projects in a piecemeal pick-a-winner style. It would be great to find a better way. Some of the great things about Tax Credits: they blend cultural and industrial mandates; there are no deadline dates, they can be qualified any time; they’re sustainable and don’t need to be funded by a pool – the more tax creditable projects, the more tax credit money is available; industry interim finances and thereby holds all the risk; they are relatively low in bureaucratic overhead, easy to administrate and fairly available to anyone and everyone who qualifies. It’s clear Tax Credits would be a huge improvement over the current systems. The problem is how to argue that they are drawing in investment to Nova Scotia and how the verification and accountability process would work on a reasonable schedule. If musicians and the attendant technicians and talent are the labour, who is analogous to the producer in the TV and Film business? Where does their financing come from? The employers of musicians and technicians are: clubs, festivals, events and ultimately the public who buys their services and products. Their financing doesn’t obviously come from away but it is capital that if not spent on regional labour would spin-off and out of the region much quicker. Clubs, venues, festivals, events and even consumers also have, in their own way, good tax accountability and verifiability through their auditable tax returns. If we offered venues and clubs a tax credit based on the Nova Scotia creative labour they employed, and if we broke the “not for profit” mind-set that the grant-based bureaucracy has instilled in festival and event organizers, a music and arts creative tax credit would be a powerful tool to encourage employment. If consumers were given a tax credit for music and art purchases it would likewise encourage cultural economic activity to develop a stronger and more well-founded local market that could build better exports. One way to mitigate the “cost” factor because investment isn’t coming in from away to justify the economic multiplier, is to make the tax credit simple and not fully refundable, meaning it’s a reduction of taxes otherwise payable not a credit that must potentially be paid out from general revenue. At what rate would a music tax credit really make a difference? What would the cost be? Though impressive economic impact numbers have been generated by music industry lobby groups, the truth is that very little hard cash, relative to GDP, is being spent by Nova Scotia companies on Nova Scotian music, arts and culture. If the conservative view were taken, a 17% tax credit would match the nominal tax rate of those employed and create a sustainable system. But it likely would not encourage employers to do more and perhaps not make any difference because of the administrative burden and interim financing. At the other end of the scale a 100% tax credit, where employers can credit taxes otherwise payable by the full amount they spend on Nova Scotian music, arts and culture would certainly have a huge impact on the ability to employ, present and promote Nova Scotian talent. Would it be sustainable? Government would simply be collecting less in taxes from business and that money would circulate at least one more time in economic activity than it otherwise would, attracting taxes at each cycle. Also, there would be cost savings in the reduction of other, now redundant, music, arts and culture pick-a-winner type funds. The market would be freed to decide – all other things equal – which talent got the most work and money. Artists Get The Benefits – Not The Paperwork All the reporting, audit, and verification would be handled by industry in year-end corporate tax returns. All benefits would ultimately be received by artists. The system would create more competition, more demand for talent and a more entrepreneurial mindset among all the players involved with less bureaucratic involvement. A slightly more complex model, especially for venues and clubs, would be to tie other benefits from other levels of government to the tax creditable talent labour. For example, HRM could have a uniform closing time but allow clubs to stay open later based on the amount they spend on NS talent. In this sense the tax credit, employing NS talent, could be valued at far over 100% without any out of pocket costs for municipal government’s partnership. The key is to structure the tax credit so the benefit is increased employment and the incentive to take on the accounting responsibilities of the system rest with business entity that have the capacity and business cycle schedule to be accountable in a timely and professional manner. Systems are already in place at finance to handle such a tax credit. There would be significant savings in other bureaucratic areas. The tax credit would encourage a new competitive free market, open to all with the talent and effort, that would find a sustainable balance. It would serve both cultural and industrials goals. The total cost in reduced business taxes would likely be less than $1m in year one and balance out at less than $10m per year in a robust local industry. (if a typical performance paid $2500 that would be a minimum of 4000 performances per year – numbers and order of magnitude bigger than what is supported now.) And artists would invest that money as they saw fit in recording, training, media, export development and equity. Other Creative Industries Once the tax credit was up and running in this way in music and arts, it would be possible to review and consider how the tax credit could be considered even more widely for all businesses employing Nova Scotian cultural workers, which could be defined widely to include everything from boat builders to web designers. Ultimately, all manufacturing work is creative and the system might be applied and opened to all industries that meet the basic benefits while creating products and services that put Nova Scotia in business with the world. In the coming months the current government or a new government will come to the table and ask us, the Creative Industries, a simple question… what do we want. We had this conversation 20 years ago and it put us on the map. Now, well, we have to have it again. Let’s look at it as an opportunity to do something awesome. To begin, the answer to the question should come in the form of a simple strategy document that identifies who we are, our economy sector, our industries, our place in the global market, our vision and values, beliefs and goals, where we want to go and how we want to get there. It should look like a simple business plan and have a clear call to action that is future-oriented, inclusive and adaptable. We want a simple film industry strategic plan from government that guides policy and decisions. We want the government to sign and commit to this plan. Here are some points that should be in that plan that I’ve cobbled together from other communities, studies and writers who’ve already worked it out. Vision and Beliefs The creative industries are increasingly important to the economic well-being of Nova Scotia. We believe that human creativity is the ultimate economic resource, and that the industries of the twenty-first century will depend increasingly on the generation of knowledge through creativity and innovation. We believe the ownership and commercial exchange of rights in intellectual property will be the major source of new wealth created in Nova Scotia in the 21st century. Creative industries are woven so deeply into the fabric of modern Nova Scotian society that every citizen is enriched by their pursuit and harmed by their undercapitalization. We believe technology and tradition and natural partners. Though all creative additions to the value chain are important, the highest value is placed on local production, intellectual property rights and copyright ownership. Creative Industries are knowledge-based and labour-intensive, creating rewarding employment and wealth. By nurturing creativity and fostering the environment where innovation can happen societies will maintain cultural diversity and enhance economic performance. Define The Sector Creative Industries are those which have their origin in individual creativity, skill and talent and which have a potential for wealth and job creation through the generation and exploitation of intellectual property. The Creative Industries refer to a range of economic activities which are concerned with the generation or exploitation of knowledge and information. The creative economy comprises advertising, architecture, art, crafts, design, fashion, film, music, performing arts, publishing, R&D, software, toys and games, TV and radio, video games and industries that preserve and promote traditional skills including boatbuilding, metalwork, and woodwork. Cultural Industries are a sub-set of Creative Industries, including textual, music, television, film production and publishing, as well as crafts and design. Goals Our goal is to merge Creativity, Culture and Industry into a seamless, sustainable, sparkling engine of prosperity and wealth creation. Cultural industries worldwide have adapted to the new digital technologies and to the arrival of national, regional and international regulatory and promotional policies. These factors have radically altered the context in which cultural goods, services, and investments flow between regions and countries globally. Consequently, these industries have undergone a process of internationalization and it is imperative that Nova Scotia compete effectively on the world stage using the best tools and techniques available. Support equal treatment and equal access to program for all meeting goals All programs, policies and incentives designed to grow and support the sector should be available to any and all Nova Scotians who succeed in Creative Industrial wealth forming pursuits and who can meet the standards of accountability and best practices. The only limit to growth in the sector should be individual’s capacity for effort. The Benchmarks of Success

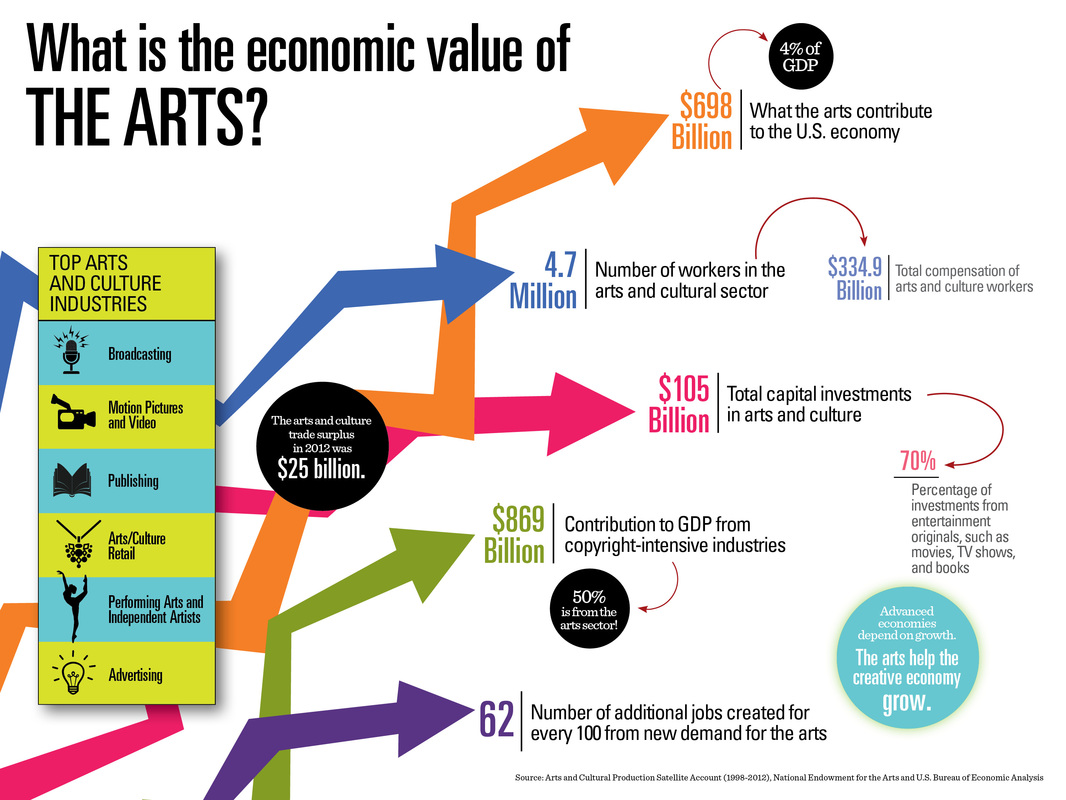

*We recognize that Economic Impact Modeling and the talk of ‘spin-offs can only be used as a comparative tool when making choices between alternate and mutually exclusive courses of action and that these tools are not useful when applied inconsistently or as a policy promotion tool. We are competing in a global market $640 billion was the value of the world’s exports of creative goods and services in 2011, of which $87 billion or 14 percent originated in the Americas, according to data compiled by Oxford Economics in the study “The Economic Impact of the Creative Industries in the Americas,” a collation of existing quantitative data on the economic performance of the creative and cultural industries. The report surveys 44 countries—including 34 countries in the Americas and 10 benchmark countries from other regions around the world. It also recommends ways to improve and standardize national measurement frameworks to better track trends within and across countries and support more evidence-based policymaking. The contribution by creative industries to GDP varies widely across the region: from just under 2 percent in Chile to more than 10 percent in Brazil and the United States. Growth rates in the sector are consistently higher than the average of the economy. The creative sector is also an important provider of employment in some countries: between 5 percent to 11 percent of jobs in Canada, Colombia, Mexico, and Trinidad and Tobago. Moreover, the sector has a higher percentage of youth employment than the rest of the economy. The sector is becoming increasingly international. Creative exports from the countries in the Americas accounted for 2.2 percent of all their exports of goods and services. Nova Scotia must commit to effectively competing on the world stage with the goal that local talent, ideas and product on par value with the world is not encumbered by geopolitical disadvantage. Our main competitor is Ontario For policy and decision-making purposes we just agree that our benchmark competitor is the market-leading work done in the province of Ontario. Marketing, regulatory and incentive policy should embrace as ‘fast first follower’ strategy to ensure a favourable competitive position. The government of Nova Scotia should be constantly working with the Ontario and Federal government to ensure fair and balanced treatment of the Canadian regional production centres, explore comparative advantage opportunities, and promote value-adding co-operation where possible. Competitive Advantages Current competitive advantages include:

Programs, Policies and Process Over 20 years Refundable Tax Credits have become the global gold standard in Economic Development Tools for creative industries. When administrated properly they are fair, accessible to all, accountable and effective. They can be adjusted easily for competitive and marketing purposes, and they have a measurable positive effect on the economy. However, they must be understood and administrated by a knowledgeable and forward thinking system of policy, process and oversight. It is this system that has fallen by the way in Nova Scotia and must be rebuilt from the bottom. Program, policy and processes do not need to reinvent the wheel. Nova Scotia has more experience with these programs than any other region. If we understand who our competitor is, our marketing strategy, and our competitive strategy the rates and particulars of the system will flow naturally from policy and be easily adapted to changing economic forces and competitive conditions. **See the blog post document "The Application of Tax Credits" for a decision tree on incentive programming using Tax Credits. Industry Marketing 2015 revealed the innate power of the sector to communicate, market and promote itself, even in the face of criticism and downturn. Industry marketing’s main goal is to bring investment, talent and jobs to Nova Scotia by empowering the industries to promote themselves. Our secondary goal is to promote Nova Scotia – products, people and as a destination for business and travel. Because it’s our proven strength, the focus of marketing should be social, viral, and sharable, seeking and creating personal direct relationships in the industry rather than old-style trade ads, displays and booths. In Relation to the Stars Creative industries are by definition less corporate than traditional industry. Relationships are important. Nova Scotian industry should focus on making great relationships with the best of the best of the world’s creative community. Financial goal is 3 % of Canada’s growing output Creative industries account for $640b in exports alone. This figure has been consistently growing at an average of 10% per year. In Film and TV, Nova Scotia currently represents about 2% of Canadian production and Canada represents about 2% of the global market. That number has grown from .2% 20 years ago. Ten times growth relative to world markets. Our goal should be to punch above our weight and reach 3% of Canadian production by 2021, while also enjoying 10% plus annual growth in global markets. Industry development – Starting Over The sector, the government and creative talent should take on the mindset and the challenge that we are starting over. We should see this as an opportunity to rebuild the unique foundation of local talent, stories and environment that enabled us to join the global market in the past.

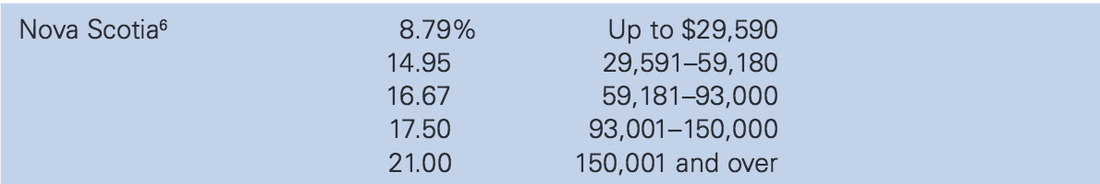

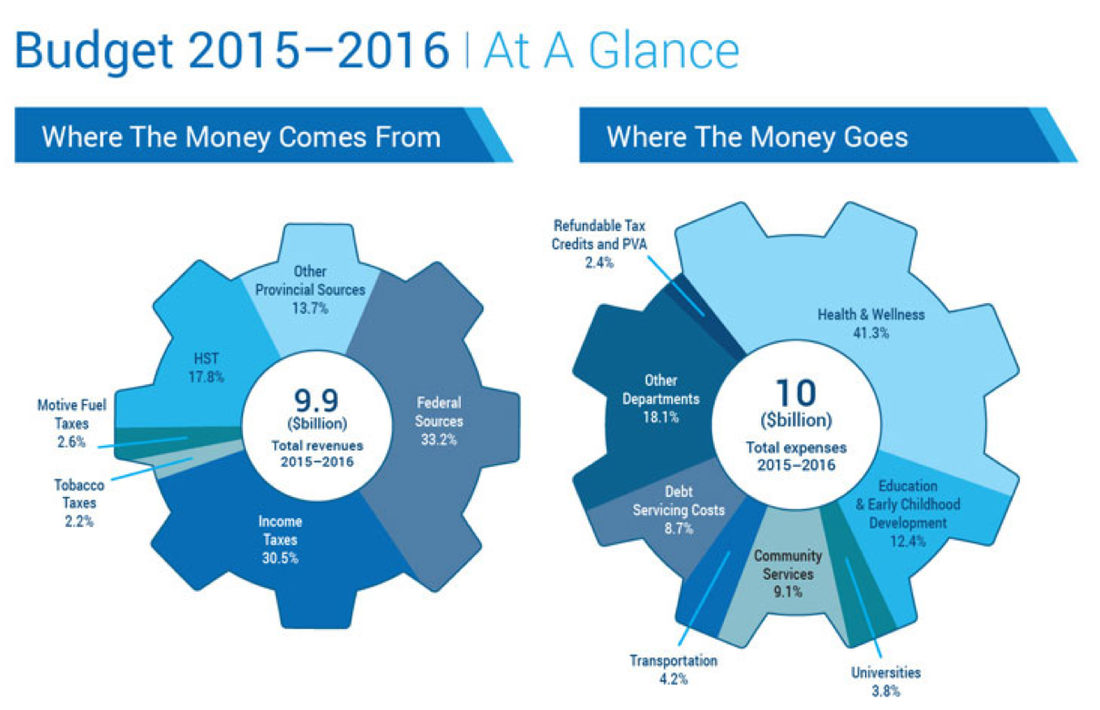

Capital, Risk, Assessment and the Shape of Things To Come Cultural Industries executive Ed Cowan wrote in the Globe and Mail this summer that our creative industries could be an ideal gateway to a long-term strategy improving our competitiveness and our capacity for innovation, leading a more certain, sustainable future economy in Canada. This section adapts his report to Nova Scotia. Already innovative tools that we’ve developed here, such as the use of Tax Credits in place of pick-a-winner style investment, have been copied and embraced by the most forward-looking global markets. Nova Scotia’s base creative industries are hugely diverse – advertising, architecture, craft, design, fashion, television, information technology, software, publishing, museums, galleries, libraries, plus the performing and visual arts – they are built on a proud tradition of creativity and storytelling. Our video game developers create some of the world’s bestselling titles. Our animators draw the shows that engage and inform the world’s children. And in television, by far the world’s number one leisure activity, our series and specials continue to entertain the world. The future potential of this market is growing with new platforms, new investment and new technology. We will be part of a golden age of entertainment. Any reduction in public investment in these industries will seriously undermine our creative and cultural ecosystems, creating a downward spiral in which fewer creative risks are taken, resulting in less innovation and declining returns, to the detriment of our economic future. If we are to grow, steps have to be taken to begin to build cross-party political support for a new sustainable economic plan, based on building the environment for innovation, with the creative industries – supported by solid government belief and understanding – leading a major charge. Step one in this initiative should evolve from the development of a creative industries mapping document, a tool kit to accurately and authoritatively measure the sector’s contribution to Nova Scotian economic health and gauge our progress, opportunities, strengths and weaknesses. A similar process was an unqualified success in Britain – in 2001, it led to the British government becoming the world’s first to recognize creativity as a proper industrial sector. The British mapping document also proved that the creative sector outperformed the rest of the British economy in both growth and job creation. A Nova Scotia commission could focus on the public and private investment required for the growth of this cornerstone sector. Tax incentives for film, television, software development, theatre and orchestras are essential, but other forms of public investment could be examined: supporting R&D, testing new ideas, developing new talent and opening doors to innovative collaboration with other industrial sectors. Stimulating this variety of investment and income is a vital national priority. Access to capital is the crucial missing ingredient. We have the talent, the labour, the natural resources. Without adequate baseline investment, we cannot expect to maintain, let alone build on, our fledgling cultural and creative successes. Our cultural and creative industries can drive technological progress, as well as benefit from it. While we are just 15 years into the digital millennium, it is crystal clear that creative and innovative uses of technology are essential to our future sustainable economic success. Ask Frankie MacDonald. The digital revolution has increased participation in informal creative activity and expanded the universe of artists into potential collaborative interfacings with other industrial sectors. It has created the opportunity for new networks and new forms of collaboration and interaction, transformed the production and distribution of established cultural content and allowed new forms of art and culture to emerge, thus enlarging the economic palette for innovation. The public sector has a vital role to play in supporting digital R&D in the creative industries, which must be aimed at increasing innovative content production, audience engagement and financial modelling – thus resulting in new forms of social value, as technologies evolve. Clearly, a strong cultural and creative ecosystem would lead to greater intrasector collaboration and innovation. Education, Culture and The Future This isn’t just about economic sustainability, though. The fruits of creative-sector collaboration, among the commercial creative industries and the purely cultural sectors, already range from familiar products, such as co-produced TV programming, to adventures in multiplatform storytelling that draw on expertise in technology, film, theatre and more. The possibilities are endless. We must also be prepared to fully harness, and financially support, the importance of creativity in education and skills development to maximize our full creative potential. Doing so will ensure an innovative future and provincial well being, based on both a traditional and a digitally based education system, and a new-world curriculum that is infused with multidisciplinary creativity and economic enterprise. Failure to understand this educational issue dramatically reduces our capacity to produce creative, world-leading scientists, engineers and technologists. Making decisive progress is both a social and economic imperative. Public and private financial resources need to be refocused across the cultural and creative industries to achieve this goal. We could take shares instead of taxes. Corporate Taxes in Nova Scotia are a mess. They are not working for anyone. And if there’s one reason why no one cares, it’s because they are such a mess that the tiny amount they generate is near immaterial to our provincial budget. But Corporate Taxes do matter. The 'carrot and stick' of corporate tax is one of the few levers of economic progress in our reach. So why would I advocate abolishing them? Nova Scotia has a personal income tax system that is among the most progressive in the world. Though it sometimes hurts it’s something we can be proud of. Here’s the deal – we all contribute fairly to a common fund that pays for our public goods and services, invests in our future, economic, cultural and social objectives and looks after the poorest and most vulnerable among us making Nova Scotia among the cleanest, healthiest, safest and most prosperous places ever in the history of the world. Take a look: It happens that those making over $150k are the “1%” in Nova Scotia. There’s a little over 6,000 taxpayers in that 1% bracket and they are paying 21% of all the income taxes. Damn decent I’d say. But there are other parts of the tax system that just aren’t working. Nova Scotia has the highest Corporate Income Tax Rates in Canada and the lowest small business threshold. And yet you don’t see Corporate Tax in the chart above. The total amount collected in corporate and capital taxes is only about half what Service Nova Scotia collects in registrations, fees and taxes per year. It’s lumped in with “other sources” and forgotten. Most large corporations operating and selling goods in Nova Scotia pay little or no taxes. New car sales account for the second largest element of consumer spending after food yet Ford and all the other car companies pay no taxes in Nova Scotia. Worse, the banks are taxed on any capital they employ in Nova Scotia leaving them a huge incentive to move all deposits out of Nova Scotia and not invest anything here they don’t have to – so we’re left with mortgages… and that’s about it. Before “income tax” became a thing in Nova Scotia there were still taxes but they were levied - sensibly - on the people and companies wanting to do business in Nova Scotia, give us junk, and extract wealth. It's time again to tax not the creation of wealth, work and income in Nova Scotia, but tax the extraction of wealth and recover the cost of all the disposable junk, packaging and garbage shipped in to Nova by global commerce. Here are three ideas about corporate taxes ranging from obvious and conservative to… BFI 1/ If we want to be competitive and attract industry our corporate tax rates should be lower than the main provincial competitor. And that seems to me to be Ontario. Because of our well-understood geopolitical disadvantages, we can’t be market leaders in taxation. A simple strategy would be to set rate 5% lower than Ontario and small business thresholds 5% higher and take on a fast first follower strategy, keeping our tax rate competitive with theirs. 2/ We should structure corporate taxation to encourage the employment of capital in Nova Scotia, not the extraction. 3/ Here’s the big f%^king idea. Currently corporate taxes accounts for only 4.9% of Nova Scotia provincial revenues. To put that in perspective it’s only about 1 tenth of the amount raised by income tax and HST. Why don’t we just give up on corporate taxes all together, save the cost of administrating a complicated and unproductive system and simply require large public corporations that want to do business in Nova Scotia to pay us in shares for the right to do business in Nova Scotia. As above, the rate – paid annually - would match competitively with Ontario. Tax avoidance would be basically eliminated. Corporate, government and public interests would be aligned, and Nova Scotia – meaning the people of Nova Scotia – would be creating a global, long-term investment in the way the world is inevitably going. Collectively we would again become owners of capital, earning dividends and capital gains, perpetually, driven in part by our own market, instead of victims of corporate globalization endlessly extracting our regional wealth and aggregating it in global centres. This idea is not new. It’s been around for generations but in times and places where corporate taxation is working to advantage it’s not pursued. Nova Scotia is not in that time and place. It’s a creative idea that could do the job. More revenue/ dividends, more capital, more control, less tax avoidance, less administrative and overhead costs. Even talking about it would put us on the global map and on the radar of corporate interests look for an advantage. And nothing could send a stronger signal to the markets and owners of capital that we’re ready, willing and able to do something 'bold', 'innovative', 'new' and partner in the long-run for shared interests instead of undermining quarterly results. Steve Jobs said "Innovation distinguishes between a leader and a follower." What role do "Leaders " play in Canadian society, among the first mature democracies in history?

Maybe the story starts with sorting out Leader, leader and leadership. Arguably Churchill, Hitler, Stalin and Mussolini we all great Leaders, and there is a portion of the population who worship power and control who would love to see more Leaders in this sense. We suspect Donald Trump might be a Leader. In spite of our most modest flirtation with this kind of Leadership, what I'll call strong arm leadership, in the Harper years, I don't think Canada is much interested in Leaders. Small "L" leaders are more our thing and I think Mr. Trudeau is a good example. He's a leader in the sense that he symbolizes and represents who we want to be and where we want to go. This kind of leader is out ahead, a figurehead, representing ideas, culture, and business as we want it to be. One of the hallmarks that distinguishes this leader from Leaders is argument. Open discussions and disagreements must be encouraged, so that all sides of an issue are fully explored. These kinds are folks we rarely see in politics because they have a lot of better things they could be doing. Many view the greatest leader of this sort in modern American history to be Adm. H. G. Rickover, USN. A generation after his work was done Americans learning leadership study his work and marvel at what he accomplished. Here's what he wrote about HOW leadership worked. These folks are interesting to us because they display a mix of attractive qualities we admire and are drawn to. In this sense leadership is a practical skill. It is simply the ability to lead or guide individuals and groups. How that is done is much more complex and represents a whole field of study. Is leadership breed or learned? Are there 'tricks' to it? Does it depend on looks, strength, IQ? How should leaders be rewarded? Should we even want leaders or should we resist these social structures as outmoded? We can think of leaders in the political sense, or as explorers and adventurers, or as executives in business. In the creative world leaders are people who, through their personality, style and presentation attract people. Even a city can be a leader - it can expect more of you, it can be insistent, it can demand excellence and punish mediocrity. Leadership means different things to different people around the world, and different things in different situations. For example, it could relate to community leadership, religious leadership, political leadership, and leadership of campaigning groups. Though how leaders do what they do may be infinity varied we can see what they do simply.

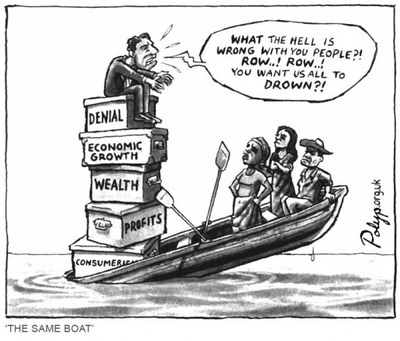

Taken together all these things 'lead' to change. Very few people have become strong or famous leaders by keeping things exactly as they are. Leadership, therefore, is about change. The number one problem in our province today is broken government. Government is on the wrong path and that path is marked by a sign that says BUREAUCRACY. The hallmark of government today is lack of dynamic change, new ideas, and risk. In Nova Scotia we rarely hear even the suggestion of big new or different ideas. Even the most "bold" political statements are just the same old things, cribbed from other places, learned from dusty old professors, and repeated since the sixties. So the first question of leadership might be, "Do we really want leaders?" Generally, I don't think we do. I think too many people have it too good. In spite of our complaints about high prices and taxes most among us have more and better than any previous generation. In this sense calls for leaders and change are just a way of talking, griping, not something we would seriously consider. Why rock the boat when we're getting our cut? But... say we did want leaders in government. How would that work. Well, first of all, we actually would not want to distract leaders too much... they are the ones out working, creating, employing, generating new wealth and attracting capital to our region. They may be far more valuable to society in the market rather than in a cabinet room. In his book Leadocracy, Jeff Smart presents a way to get real leaders and leadership into government. The solution, he argues, is hiring great leaders into government and empowering them to work. If we can replace bureaucratic non-leaders with great leaders who have the courage to act and be responsible we can improve Nova Scotia. So, if it’s this simple what’s the problem? Let’s just do it. Well, there is an obstacle in the way and it’s not the obvious one. What’s really stopping us from improving government bureaucracy through a “leadocracy”? What is stopping our best leaders from engaging in government? Money is an issue; government being held in low regard, ill-repute even, are issues. The loss of privacy; being exposed to public criticism, are issues. But these are easily overcome. Leaders need only offer a term, a couple years – it won’t have much effect on their lifetime earnings. We can surely muster the public tact to appreciate and thank leaders for their public service and define systems to respect their efforts even in a wild media age. The real problem is the notion of empowerment. Why would leaders even try in a system they know is impervious to improvement or change of any kind? In Nova Scotia we’ve fundamentally eliminated risk and responsibility from public life and government. No one is responsible. No one can be held accountable. No one can be fired no matter how abysmally mediocre their effort. The new trend to extensive public consultation, though wonderful on the surface, is making things much worse. It is actually replacing democracy with a type of paralysis marked by complete absence of responsibility in decision-making even in our elected officials – the very core value of democracy. When more than one person is responsible, no one is responsible. Leaders are smart. They can see this and they steer clear. This is what has to change if we really want change. Leaders are also good-hearted and concerned. So what happens? Leaders ‘softly contribute’. They join political parties. Give to charities. They join boards, commissions and taskforces (***cough, Ivany, cough***). They offer their time and their support. And here’s the tragedy. In going along with the system, but without taking real responsibility for the outcome, they become part of the problem. The history of our province is paved with reports – mere observation by people who were born to act decisively. The bureaucracy, like a zombie hoard, transforms our greatest leaders into bureaucrats, consultants, advisors and board members. Slapping on the back, congratulating and rewarding them generously for mediocrity. Exactly the opposite of what we need. Nowhere is this more poignantly painted than in the story of one of Nova Scotia's first great leaders, Joseph Howe. To give an example; imagine instead of being invited to sit on a panel and toss around some ideas, or asked to contribute to this charity or that, Al MacPhee, a local Auto impresario, was empowered to be Minister of Highways for a four year term. And imagine he was empowered to institute more efficient and effective policies, laws and management practices based on his leadership skills and experience. Imagine that he was asked to be responsible and accountable for this work as he has been for hundreds and thousands of jobs and hundreds of millions of dollars in business. Government is broken. We can fix it by stopping it and, where it is necessary, putting leaders from outside politics and government into the position of responsibility with the terms and with the tools to fix it. We can build a Leadocracy... if we actually want change. My personal view is that we don't want leaders because as citizens we're not willing to take on the responsibility and work of change. The Changing Role of Capital In Society"The arts community is generally dominated by liberals because if you are concerned mainly with painting or sculpture, you don't have time to study how the world works. And if you have no understanding of economics, strategy, history and politics, then naturally you would be a liberal." Mark Helprin This is a pitch for talking everyday economics. It's pointed at all my friends who openly say they don't like numbers. Contrary to popular belief learned in crap high schools, economics is a social science that is the only language we have for getting to the good life - the prosperity that we all have the audacity to want for Nova Scotia. Economics is the story we tell ourselves about where our wealth comes from and where it goes.

So economics is a story. And we’re all story experts. So we get frustrated when the story doesn’t make sense, when characters are left out, when plot points don’t seem realistic, when there's bad edits, when the bad guys don’t get their due and when the love interest isn’t brought forward to be central to the story. Then we stop believing. It's All Economics Whether we like it or not, it is a fact that the main issues of present-day politics are purely economic and cannot be understood without a grasp of that subject. Without an understanding of the main problems of economics citizens are merely repeating what they have picked up by the way, chasing self-interests without regard to the big picture, or worse ignorantly acting against their own self-interests. They are easy prey to demagogic swindlers and idiotic quacks. Citizen gullibility and incredulity is the most serious menace to the preservation of our way of life, our resources and the shape of things to come. Economics studies the decisions we make Economics is about much more than accounting, inflation, and supply and demand. At its core, economics studies how people make decisions. Households, companies and whole societies face a series of decisions--what to have for dinner, whether to invest in new equipment, how to fund infrastructure. Economics provides valuable insights into how societies make decisions about their needs and wants and allocates the resources to achieve them. Economics provides a framework for understanding the actions and decisions of individuals, businesses and governments. It provides a means to understand society and for analyzing government policies that affect the families, jobs and lives of citizens. The biggest mistake in Economics The study of economics in Nova Scotia is lazy. Where economics fails it takes too narrow a view and doesn’t consider the broadest possible implications of any policy or decision, now and into the future, for all groups rather than just a few. We want our stories to be inclusive not for just a few. Pick-a-winner crony capitalist economic development is perhaps the worst example of this. It has discouraged tens of thousands in society for every backroom boy it has helped. We only have three resources It's a classic hero's journey. Economics is the social science that examines how individuals, businesses and entire societies manage scarce resources. Resources can come in three forms: land, labour and capital. Resources are, by nature, limited. Only a finite amount of land exists, for example, and people do not have unlimited time to meet all of their needs and wants. Because no resources exist in unlimited quantities, societies must establish priorities and decide how best to allocate resources in such a way that meets as many needs and wants as possible. Capital - Our Lost Treasure A dramatically changing mix of resources used to create the wealth and prosperity we want is the hallmark of the modern age. Though the value of the natural resources in land remains the same it’s relatively less important. The role of labour has been steadily declining for 200 years and exponentially so today. The relative role of capital has become the single most important resource in wealth creation and increased prosperity. Capital, in economics, is the mix of technology, machines, intellectual ideas and knowledge, cash money, access to debt, markets and distribution that enables labour to add value to natural resources. The better capital is employed the more productive labour becomes. Today, globally, labour is very productive. But in Nova Scotia, like in many rural regions, access to capital has not been much of a concern because we simply extract resources to be sent and processed elsewhere. We are far behind, and far less productive because we do not have access to capital, even in the form of our own wealth. Capital is so rare and so drained from our rural region that the McNeil government, Ivany and the rest, like all Nova Scotia governments before it, can’t conceive of it. They stare Golum-like at the provincial treasury mistaking that for our wealth. It's not. They are wrong. It's not even a fraction of our wealth. They can only imagine adding more labour or drawing down more natural resources from the land to create more wealth. This will not work. This is not how the modern world works now or going into the future. The government’s austerity plan is all pain and no gain. Ivany’s adding of more labour is only good for land speculators, monopolists (like the power company) and government. It will not create new wealth for citizens – in fact, each citizen will be individually less well off. Real wealth is created by drawing down fewer natural resources, differentiating them, and processing them to their highest possible use using very limited highly-productive labour by effectively employing capital. Getting Informed and Government For society, economics provides a scientific approach to analyzing and understanding government decisions for ensuring stable economic growth with sustainable output and the highest possible level of employment. Economic methods also provide the tools by which policy analysts, and regular people, study the possible costs, benefits and effects of government policies in a range of areas, from the environment to health care and education. Economic principles can help guide the actions that help foster a prosperous society. Economics is evolving and will help provide answers for dealing with policy issues that affect the future. |

John Wesley

Writing about life, citizenship, and Nova Scotia. Archives

June 2020

Categories

All

|

RSS Feed

RSS Feed